Table of Contents

A good credit score opens up a wide range of financial opportunities for you, from taking loans to getting credit cards, and even rental agreements. In fact, it depicts the potential of a person’s financial responsibility and the probability of paying his debts back. But what actually is a good credit score, and how are you going to improve it or maintain it? We explain in more detail below what comprises a good credit score, and why, then outline some real steps you can take in achieving or maintaining it.

Understanding Credit Scores

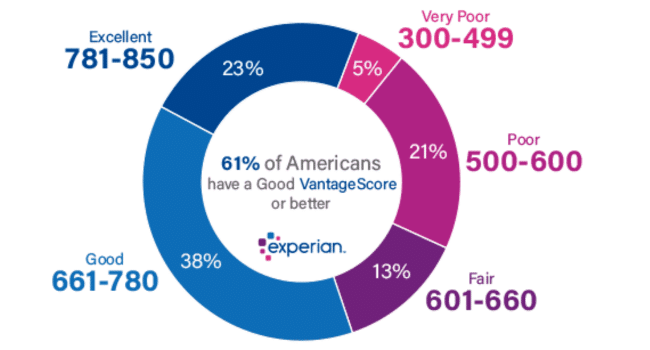

A credit score is a number corresponding to an individual’s past regard to credit. It is usually sourced from credit bureaus and considers such elements as the history of paying bills, utilization of credit, the period of credit history, and new inquiries for credit. Common models that estimate credit scores include FICO and VantageScore. Credit scores range from a low score of 300 to a high score of 850.

Generally, a credit score falls into the following categories:

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

A very good credit score ranges from 670 to 739. That would mean you have an average history with credit, in that you will get most of the financial products approved, which may not be at the best interest rates compared to higher scores.

Why a Good Credit Score Matters

The credit score opens many doors in financial products and services. Basically, your credit score helps the lender decide on the risk associated with lending money to you. The higher the score, the less riskier you are on their books. Given below are some of the reasons it is essential to keep a good credit score:

- Much better loan terms: When your credit score is good, you get loans with much lower interest rates automatically, therefore saving your money in the long run.

- Credit Card Approvals: Most probably, with such an excellent score, you may get approved for those top-of-the-line credit cards offering cash-back rewards, travel points, and very minimal fees.

- Less Expensive Insurance: Some insurance companies base their premiums on a person’s credit rating. If your rating is excellent, you will not have to pay as much for insurance.

- Apartment Rentals: Most landlords would want to scrutinize your credit score and determine whether you are financially capable enough to lease your property.

How to Achieve a Good Credit Score

It takes discipline and planning to achieve and maintain a good credit score. Here are some ways you can improve or build your credit score over time.

1. Pay Bills on Time

You cannot be reminded enough that the most critical determinant of your credit score is your payment history, composed of about 35% of the score in the FICO model. Be sure to pay bills on time related to credit cards, loans, utilities, etc. Just one missed payment can lower a credit score.

2. Low Credit Utilization

Credit utilization means the usage of your available credit at any given time. A low credit utilization ratio of less than 30% will have a positive effect on your score. That is to say, for example, if your limit is $10,000, you must not let your balance rise above $3,000 if you are to keep your utilization sound.

3. Maintain a Long Credit History

Your credit history length accounts for about 15% of your score. The longer you have had credit accounts open, the better that is for your score-only in the case that you have managed them responsibly. If at all possible, avoid closing older accounts since they help your overall credit history.

4. Limit Hard Credit Inquiries

Basically, every new credit line-one for credit cards or loans-results in a hard inquiry on your credit report. How often this may happen can directly affect your score and may even drop if too many inquiries happen within a short period of time. To avoid this, apply for credit only when it is absolutely necessary, spacing the applications out over time.

5. Diversify Your Credit Mix

Credit mix, including credit cards, auto loans, and mortgages-can be helpful in enhancing your credit score. It’s good to let the lender recognize that you can manage different types of credit responsibly, and this aspect contributes about 10% of your score.

That said, financial freedom wants a good credit score that would help you qualify for better interest rates and get approvals for loans or even save on insurance. The involved methods in keeping a good score include paying bills consistently well on time, having low credit utilization, having a long credit history, and keeping in mind the number of times one applies for new credit. This is done overtime through the pursuit of these strategies, with regular checks on one’s credit.